By Ara Marcen Naval, Head of Advocacy – Transparency International Defence & Security

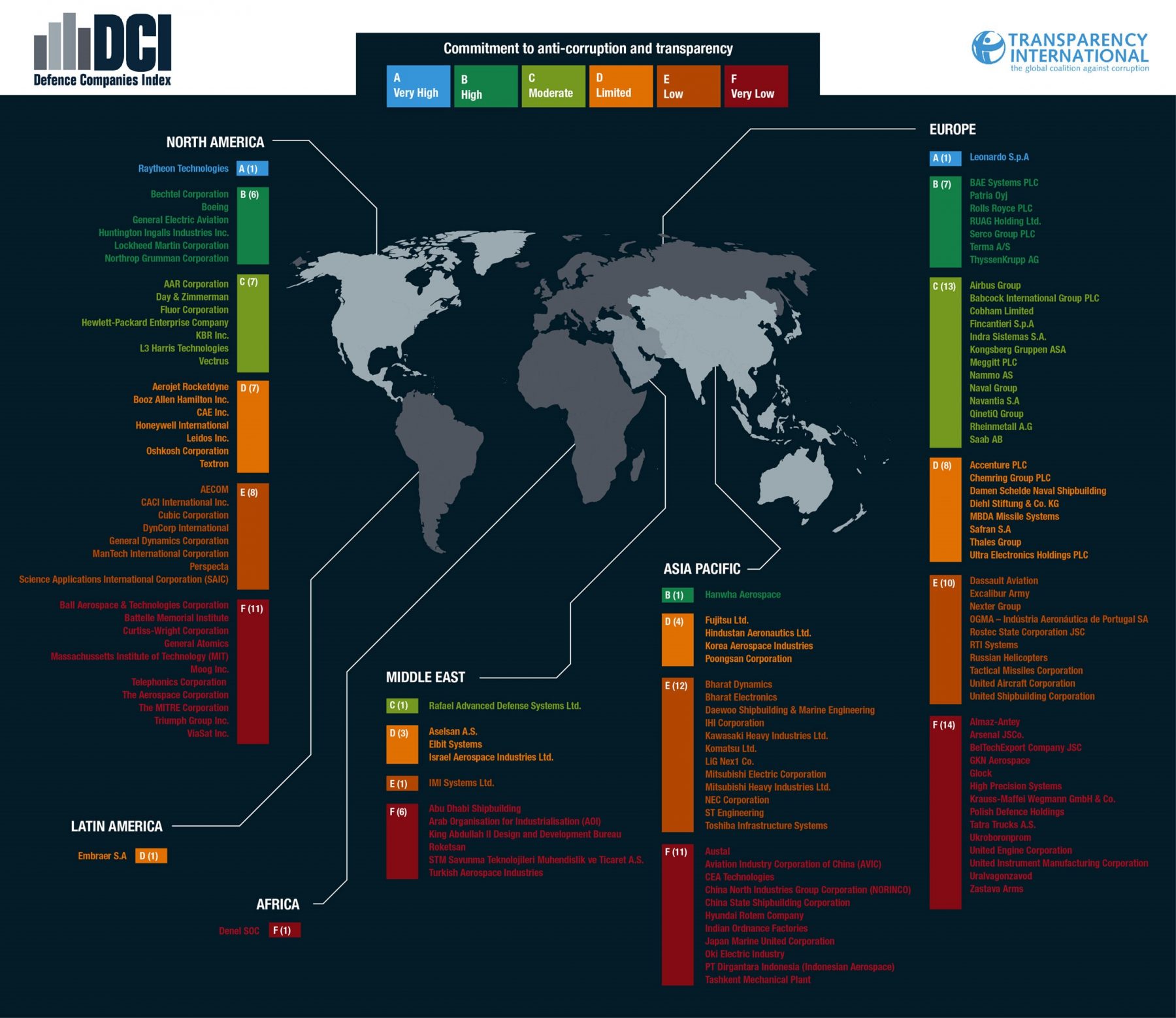

Nearly three-quarters of the world’s largest defence companies show little to no commitment to tackling corruption. That’s the headline finding from our newly published Defence Companies Index on Anti-Corruption and Corporate Transparency (DCI). It assesses 134 of the world’s leading arms companies, ranking their policies and approach to fighting corruption from A to F.

The statistic is deeply concerning, if not altogether surprising to those familiar with the defence industry. Reducing corruption in the defence sector is imperative to guarantee safety and security. Yet, a veil of secrecy, invoked ostensibly in the interests of national security, shrouds the defence sector’s activities making it especially vulnerable. The widespread use of middlemen, whose identities and activities are kept secret, further limits oversight. The impact of corruption in the arms trade is particularly pernicious. The high value of defence contracts means that huge amounts of public money may be wasted, instead of being spent on essential public services. Corruption can encourage the excessive accumulation of arms, increase the circumvention of arms controls and facilitate the diversion of arms consignments to unauthorized recipients, perpetuating conflict and costing lives and undermining democracy.

According to the Stockholm International Peace Research Institute, of the world’s 10 largest importers of major arms between 2015-2019, eight countries – Saudi Arabia, Egypt, Algeria, Iraq and Qatar, UAE, China and India – are at high, very high or critical of corruption in the defence sector as measured by our Government Defence Integrity Index, the DCI’s sister index. Critical risk of defence sector corruption means major arms are sold to countries where they are likely to further fuel corruption, and where appropriate oversight and accountability of defence institutions is virtually non-existent.

The findings of the DCI add to this worrying picture. Nearly two thirds (61%) of the companies assessed show no clear evidence of policies or processes to assess and manage risk in markets they operate in. In addition, only 10% of the companies actively disclose full details of countries in which they and their subsidiaries operate, leaving a major gap in transparency and oversight of corporate activity.

Click here to view full screen.

The DCI has revealed that many companies score well on the quality of their internal anti-corruption measures, such as public commitments to fighting corruption and processes to prevent employees from engaging in bribery. However, because most companies publish no evidence on how these policies work in practice, it is impossible to know whether they are actually effective. Many firms do not publicly acknowledge they face increased risks when doing business in corruption-prone markets nor do they have apparent measures in place to identify and mitigate these risks. Few take measures to prevent corruption in ‘offsets’ – controversial side deals that involve a company reinvesting some of the proceeds of an arms deal into the customer’s economy but are banned in other sectors because of the corruption risks such deals pose – and most do little to counter the high-risk of bribery associated with using agents and intermediaries to broker deals on their behalf.

It is essential that companies have procedures in place to deal with these often opaque and high-risk aspects of the defence sector – including agents and intermediaries, joint ventures, offset contracting and operating in geographies considered at high risk of corruption.

We urge defence companies to increase corporate transparency through meaningful disclosures of:

- their corporate political engagement – a particularly high-risk issue in the defence sector -including their political contributions, charitable donations, lobbying and public sector appointments for all jurisdictions in which they are active;

- their procedures and the steps taken to prevent corruption in the highest risk areas, such as their supply chain, agents and intermediaries, joint ventures and offsets;

- procedures for the assessment and mitigation of corruption risks associated with operating in high-risk markets, a major risk for defence companies, as well as acknowledgement of the corruption risks associated with such practices;

- beneficial ownership and advocate for governments to adopt data standards on beneficial ownership transparency;

- all fully consolidated subsidiaries and non-fully consolidated holdings, and to state publicly that they will not work with businesses which operate with deliberately opaque structures; and

- the nature of work, their countries of operation and the countries of incorporation of their fully consolidated subsidiaries and non-fully consolidated holdings.

The DCI provides a roadmap for better practice within the defence industry. It promotes appropriate standards of anti-corruption and transparency of policies and procedures suited to the risks faced in the defence sector. Adopting these will not only reduce corporate risk, but also increase accountability and reduce the risk of corruption in the sector more widely.